Posted on

January 30, 2019

by

Savannah Magnussen

Economic challenges to affect Calgary’s housing market in 2019

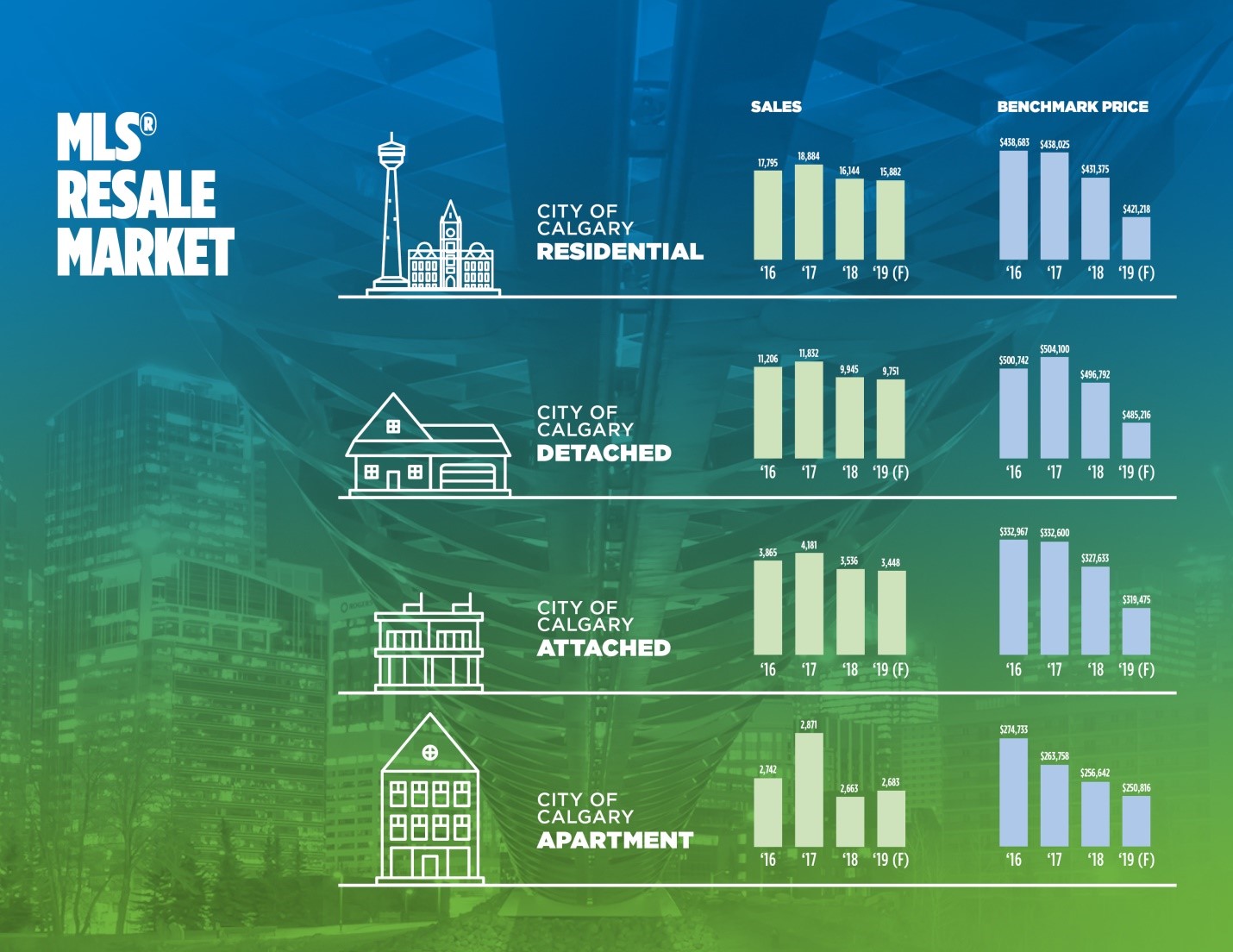

The challenging economic climate in Calgary is expected to persist into 2019.

Easing global oil prices, concerns regarding market access and easing investment activity are weighing on the energy sector and are expected to slow growth prospects in the province this year.

"Slowing growth, weak job prospects and lack of confidence are all factors that are contributing to the expected easing in sales activity this year," said Ann-Marie Lurie, CREB® Chief Economist.

"At the same time, our market continues to struggle with high inventory levels and further potential rate hikes, all of which is expected to cause additional price declines this year."

There are signs that supply in the market is starting to adjust to slower sales, but the pace of adjustment is expected to be slow. Overall, it will help reduce some oversupply in the market and put the industry in a more stable position by 2020.

Buyers' market conditions are expected to persist throughout most of the year, impacting prices across all property types. However, the pace of decline is expected to ease by the end of the year, as concerns over the economy ease.

While further easing in the housing market is expected, this will not likely be the case for all price ranges, as demand for affordable product is expected to continue to improve, given shifts in lending requirements and adjustments in expectations.

"In this market, buyers have the advantage of choice. A REALTOR® can help buyers find a home that best fits their lifestyle," said Alan Tennant, CREB® CEO.

"For home sellers, knowing all the data and facts surrounding their home is critical to maximize their selling price. Working with a real estate professional can take the guess work out of the process."

Posted on

October 1, 2018

by

Savannah Magnussen

Media release from the Calgary Real Estate Board (CREB) October 1, 2018

With no change in the economic climate, Calgary's sales activity totaled 1,272 units in September, a 13 per cent decline over the previous year and well below long-term averages. There was a pullback in sales across all product types, most notably the detached market.

"Calgary's economy continues to struggle with unemployment, which rose again last month to over eight per cent. Concerns in the employment market, higher lending rates and shaken confidence are weighing on housing demand," said CREB® chief economist Ann-Marie Lurie.

"At the same time, supply levels continue to remain high, resulting in persistent oversupply and price declines."

Inventories totaled 7,941 units, pushing the months of supply to 6.25. This continuation in oversupply is placing downward pressure on prices. The unadjusted citywide benchmark price totaled $428,700 in September. This is nearly one per cent below last month and three per cent below last year's levels.

"This is the new normal of Calgary's real estate," said CREB® president Tom Westcott.

"Some potential buyers may want to take advantage of the market conditions, but they face difficulties selling their existing home based on their expectations. This prevents them from purchasing something else."

September sales have dipped, but third quarter figures generally point towards a slower decline in sales and some easing in new listings growth. This was not enough to impact inventory levels this quarter.

The Calgary economy continues to struggle, but there are some signs of improvement in the rental market, which could contribute to a slow reduction in overall housing supply,

HOUSING MARKET FACTS

Detached

- Year-to-date sales eased to 7,945 units, over 20 per cent below the 10-year average. Sales eased across all price ranges, except properties under $300,000, which posted a modest gain.

- Easing sales were met with some adjustments in new listings in September. However, inventories remain elevated and are higher than long-term averages in most districts.

- Months of supply rose to 5.5 months in September and continue to weigh on housing prices across all districts.

- Detached benchmark prices totaled $493,100 in September. This is a 0.8 per cent decline over last month and three per cent below the previous year.

- Prices have trended down in most districts in September. However, on a year-to-date basis, benchmark prices remain above last year in both the City Centre and West districts.

Apartment

- The apartment sector has seen the slowest decline in sales at six per cent so far this year. Like the detached sector, activity remains over 20 per cent below long-term averages, totaling 2,103 sales.

- For the fourth month in a row, new listings have generally trended lower than levels recorded last year. This has helped reduce some of the inventory in the market compared to the previous year.

- However, even with some reductions in inventory levels, the market continues to remain firmly in buyer's territory when compared to the reduction in sales.

- With more supply than demand, benchmark prices for apartment condominium continued to ease in September, declining by 0.4 per cent over last month and 2.7 per cent compared to last year.

Attached

- The attached sector has recorded year-to-date sales of 2,814. This is 15 per cent below last year and 14 per cent below long-term averages.

- With no significant reduction in new listings, inventory levels remained elevated, pushing up months of supply to over seven months.

- Elevated levels of supply compared to demand persisted for both row and semi-detached product types. Like all other sectors, the oversupply has weighed on prices across all districts, except the City Centre, North East and East.

- While September semi-detached benchmark prices eased, year-to-date prices remained just above last year's levels. The recent oversupply has eroded some of the steps made toward price recovery last year.

- Row benchmark prices have averaged $298,667 this year, nearly two per cent below last year and nine per cent below previous highs. Despite the citywide pullback, row prices have remained relatively stable in the City Centre, North West and South East districts.

REGIONAL MARKET FACTS

Okotoks

- Okotoks is facing supply pressures in the market due to slowing sales and increases in new listings.

- Despite the presence of oversupply, benchmark prices have managed to remain relatively stable in the third quarter compared to the previous quarter. At $436,422, year-to-date detached benchmark prices have averaged nearly one per cent higher than the previous year, but remain three per cent below previous highs.

|

Media release: Persistent buyers’ market continues

City of Calgary, October 1, 2018 – With no change in the economic climate, Calgary's sales activity totaled 1,272

|

|

Airdrie

- Airdrie's housing market has exhibited buyer's market conditions so far this year. This is largely due to weak economic conditions that have hindered growth in demand. This does not help alleviate excess supply and has led to a downward pressure on benchmark prices for detached homes.

- Year-to-date total residential sales in Airdrie have declined compared to last year and sit at levels comparable to activity recorded in 2012. Meanwhile, new listings have remained elevated, causing inventories to reach new highs for September.

- Elevated months of supply have continued to place downward pressure on prices. The year-to-date detached benchmark price averaged $371,244. This is a 1.7 per cent decline from 2017 levels and five per cent below previous highs.

Cochrane

- Affected by similarly weak economic conditions, the housing market in Cochrane has also experienced slight supply-side imbalances.

- Year-to-date sales in the town were recorded at 477 units, 59 units lower than 2017. Sales growth has been trending downward for most of the year. However, levels in 2018 are still higher than those recorded in 2015 and 2016.

- New listings in Cochrane have been persistently growing for most of the year and year-to-date levels are 269 units higher than long-term averages. Inventories have now reached a new September peak at 360 units, leading to elevated months of supply.

- The oversupply in the market has started to cause prices to trend down in the third quarter. However, it has not been enough to erase earlier gains, leaving year-to-date benchmark prices just above last year's levels. So far this year, detached prices remain four per cent below recent highs.

|

units in September, a 13 per cent decline over the previous year and well below long-term averages. There was a pullback in sales across all product types, most notably the detached market.

"Calgary's economy continues to struggle with unemployment, which rose again last month to over eight per cent. Concerns in the employment market, higher lending rates and shaken confidence are weighing on housing demand," said CREB® chief economist Ann-Marie Lurie.

"At the same time, supply levels continue to remain high, resulting in persistent oversupply and price declines."

Inventories totaled 7,941 units, pushing the months of supply to 6.25. This continuation in oversupply is placing downward pressure on prices. The unadjusted citywide benchmark price totaled $428,700 in September. This is nearly one per cent below last month and three per cent below last year's levels.

"This is the new normal of Calgary's real estate," said CREB® president Tom Westcott.

"Some potential buyers may want to take advantage of the market conditions, but they face difficulties selling their existing home based on their expectations. This prevents them from purchasing something else."

September sales have dipped, but third quarter figures generally point towards a slower decline in sales and some easing in new listings growth. This was not enough to impact inventory levels this quarter.

The Calgary economy continues to struggle, but there are some signs of improvement in the rental market, which could contribute to a slow reduction in overall housing supply,

HOUSING MARKET FACTS

Detached

- Year-to-date sales eased to 7,945 units, over 20 per cent below the 10-year average. Sales eased across all price ranges, except properties under $300,000, which posted a modest gain.

- Easing sales were met with some adjustments in new listings in September. However, inventories remain elevated and are higher than long-term averages in most districts.

- Months of supply rose to 5.5 months in September and continue to weigh on housing prices across all districts.

- Detached benchmark prices totaled $493,100 in September. This is a 0.8 per cent decline over last month and three per cent below the previous year.

- Prices have trended down in most districts in September. However, on a year-to-date basis, benchmark prices remain above last year in both the City Centre and West districts.

Apartment

- The apartment sector has seen the slowest decline in sales at six per cent so far this year. Like the detached sector, activity remains over 20 per cent below long-term averages, totaling 2,103 sales.

- For the fourth month in a row, new listings have generally trended lower than levels recorded last year. This has helped reduce some of the inventory in the market compared to the previous year.

- However, even with some reductions in inventory levels, the market continues to remain firmly in buyer's territory when compared to the reduction in sales.

- With more supply than demand, benchmark prices for apartment condominium continued to ease in September, declining by 0.4 per cent over last month and 2.7 per cent compared to last year.

Attached

- The attached sector has recorded year-to-date sales of 2,814. This is 15 per cent below last year and 14 per cent below long-term averages.

- With no significant reduction in new listings, inventory levels remained elevated, pushing up months of supply to over seven months.

- Elevated levels of supply compared to demand persisted for both row and semi-detached product types. Like all other sectors, the oversupply has weighed on prices across all districts, except the City Centre, North East and East.

- While September semi-detached benchmark prices eased, year-to-date prices remained just above last year's levels. The recent oversupply has eroded some of the steps made toward price recovery last year.

- Row benchmark prices have averaged $298,667 this year, nearly two per cent below last year and nine per cent below previous highs. Despite the citywide pullback, row prices have remained relatively stable in the City Centre, North West and South East districts.

REGIONAL MARKET FACTS

Airdrie

- Airdrie's housing market has exhibited buyer's market conditions so far this year. This is largely due to weak economic conditions that have hindered growth in demand. This does not help alleviate excess supply and has led to a downward pressure on benchmark prices for detached homes.

- Year-to-date total residential sales in Airdrie have declined compared to last year and sit at levels comparable to activity recorded in 2012. Meanwhile, new listings have remained elevated, causing inventories to reach new highs for September.

- Elevated months of supply have continued to place downward pressure on prices. The year-to-date detached benchmark price averaged $371,244. This is a 1.7 per cent decline from 2017 levels and five per cent below previous highs.

Cochrane

- Affected by similarly weak economic conditions, the housing market in Cochrane has also experienced slight supply-side imbalances.

- Year-to-date sales in the town were recorded at 477 units, 59 units lower than 2017. Sales growth has been trending downward for most of the year. However, levels in 2018 are still higher than those recorded in 2015 and 2016.

- New listings in Cochrane have been persistently growing for most of the year and year-to-date levels are 269 units higher than long-term averages. Inventories have now reached a new September peak at 360 units, leading to elevated months of supply.

- The oversupply in the market has started to cause prices to trend down in the third quarter. However, it has not been enough to erase earlier gains, leaving year-to-date benchmark prices just above last year's levels. So far this year, detached prices remain four per cent below recent highs.

Okotoks

- Okotoks is facing supply pressures in the market due to slowing sales and increases in new listings.

- Despite the presence of oversupply, benchmark prices have managed to remain relatively stable in the third quarter compared to the previous quarter. At $436,422, year-to-date detached benchmark prices have averaged nearly one per cent higher than the previous year, but remain three per cent below previous highs.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

- 30 -

For more information, please contact:

Terence Leung

Supervisor, External Relations & Media

Phone: 403-781-1349

Email: terence.leung@creb.ca

|

|

Categories:

2018

|

2019

|

2020

|

2020 Real Estate

|

A-7662, Diamond Valley Real Estate

|

Acadia, Calgary Real Estate

|

Airdrie Real Estate

|

Airdrie, Airdrie Real Estate

|

Alberta

|

Arbour Lake, Calgary Real Estate

|

Aspen Woods, Calgary Real Estate

|

Auburn Bay, Calgary Real Estate

|

Beltline, Calgary Real Estate

|

Black Diamond, Black Diamond Real Estate

|

Braeside, Calgary Real Estate

|

Bridlewood, Calgary Real Estate

|

Buying a home

|

calgary

|

Calgary Investment Property

|

Calgary Real Estate

|

Capitol Hill, Calgary Real Estate

|

Carstairs, Carstairs Real Estate

|

Cayley, Cayley Real Estate

|

Cedarbrae, Calgary Real Estate

|

Chaparral Valley, Calgary Real Estate

|

Chaparral, Calgary Real Estate

|

Charleswood, Calgary Real Estate

|

Community Event

|

contest

|

Copperfield, Calgary Real Estate

|

Coventry Hills, Calgary Real Estate

|

Cranston, Calgary Real Estate

|

CREB

|

De Winton, De Winton Real Estate

|

Deer Ridge, Calgary Real Estate

|

Deer Run, Calgary Real Estate

|

Douglasdale/Glen, Calgary Real Estate

|

Dover, Calgary Real Estate

|

Eau Claire, Calgary Real Estate

|

Events

|

Evergreen, Calgary Real Estate

|

Falconridge, Calgary Real Estate

|

Family Activities

|

Family Day 2018

|

First Time Home Buyer

|

Fixer Upper

|

Forecast

|

Forest Lawn, Calgary Real Estate

|

free pumpkin

|

Giving Back

|

Glenbrook, Calgary Real Estate

|

Harvest Hills, Calgary Real Estate

|

Heritage Pointe, Heritage Pointe Real Estate

|

High River, High River Real Estate

|

Investment Property

|

Killarney/Glengarry, Calgary Real Estate

|

Lake Bonavista, Calgary Real Estate

|

Legacy, Calgary Real Estate

|

Light Up Okotoks

|

Live Chat

|

Longview, Longview Real Estate

|

Magnussen Advantage

|

Mahogany, Calgary Real Estate

|

Maple Ridge, Calgary Real Estate

|

Market Update

|

McKenzie Lake, Calgary Real Estate

|

McKenzie Towne, Calgary Real Estate

|

Millrise, Calgary Real Estate

|

Mission, Calgary Real Estate

|

Montgomery, Calgary Real Estate

|

Moving to Okotoks

|

Nanton, Nanton Real Estate

|

New Brighton, Calgary Real Estate

|

Nolan Hill, Calgary Real Estate

|

Ogden, Calgary Real Estate

|

Okotoks

|

Okotoks Community Events

|

okotoks event

|

Okotoks home buyer

|

Okotoks Homes for Sale

|

Okotoks Investment Property

|

Okotoks MLS Listings

|

Okotoks Real Estate

|

Okotoks Real Estate Team

|

Okotoks Realtor

|

Okotoks, Okotoks Real Estate

|

Open House

|

Palliser, Calgary Real Estate

|

Panorama Hills, Calgary Real Estate

|

pumpkin patch

|

Real Estate

|

real estate advice

|

real estate advie

|

Real Estate Tips

|

remax

|

Remax Okotoks

|

Remax Real Estate

|

Remax Realtor Okotoks

|

Renfrew, Calgary Real Estate

|

Riverbend, Calgary Real Estate

|

Rural Foothills County, Rural Foothills County Real Estate

|

Rural Foothills M.D., Rural Foothills M.D. Real Estate

|

Rural Kneehill County, Rural Kneehill County Real Estate

|

Rural Rocky View MD, Rural Rocky View County Real Estate

|

Saddle Ridge, Calgary Real Estate

|

Scholarship

|

Seton, Calgary Real Estate

|

Signal Hill, Calgary Real Estate

|

Silver Springs, Calgary Real Estate

|

Somerset, Calgary Real Estate

|

Southwood, Calgary Real Estate

|

St Andrews Heights, Calgary Real Estate

|

Sundance, Calgary Real Estate

|

Sunnyside, Calgary Real Estate

|

Thing to do in Okotoks

|

Things to do in Calgary

|

Things to do in Okotoks

|

Turner Valley, Turner Valley Real Estate

|

Tuscany, Calgary Real Estate

|

Varsity, Calgary Real Estate

|

video

|

Walden, Calgary Real Estate

|

Willow Park, Calgary Real Estate

|

Winston Heights/Mountview, Calgary Real Estate

|

Woodlands, Calgary Real Estate

|