Buying a Home: What Expenses to Expect

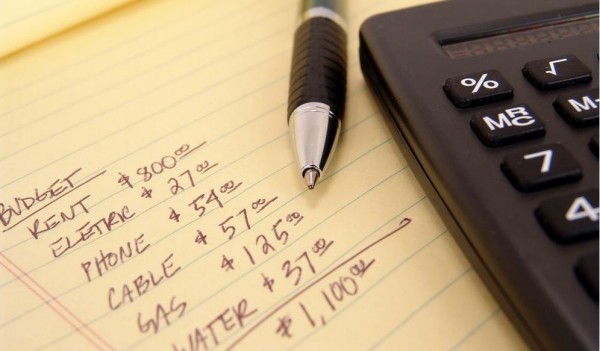

Budgeting for the purcahse of a home can be tricky. Not only are there mortgage installments and the down payment to consider, there are a host of other (sometimes unexpected) expenses to add to the equation. The last thing you want is to be caught financially unprepared, blindsided by taxes and other hidden costs on closing day.

Budgeting for the purcahse of a home can be tricky. Not only are there mortgage installments and the down payment to consider, there are a host of other (sometimes unexpected) expenses to add to the equation. The last thing you want is to be caught financially unprepared, blindsided by taxes and other hidden costs on closing day.

Our Remax Real Estate Team has prepared a detailed list of some of the common costs associated with a real estate purchase. These expenses can vary: some of them are one-time costs, while others will take the form of monthly or yearly installments. Some may not even apply to your particular case. But it’s best to educate yourself about all the possibilities, so you will be prepared for any situation, armed with the knowledge to budget accordingly for your move.

Use the following list to determine which costs will apply to your situation prior to structuring your budget:

Purchase offer deposit

When making an offer to purchase, you must submit a deposit. The amount of the deposit will vary depending on the price of the property.

Inspection by certified building inspector

Appraisal fee

Your lending institution may request an appraisal of the property. The cost of this appraisal is your responsibility.

Survey fee

If the home you’re purchasing is a resale (as opposed to a newly built home), your lending institution may request an updated property survey. Most often the cost falls on the seller, but in rare cases it will be your responsibility and will range from $700 to $1000.

5% GST

This tax applies to newly built homes only, or existing homes that have recently undergone extensive renovations

Legal fees

A lawyer should be involved in every real estate transaction to review all paperwork and handle the transfer of funds. Experience and rates offered by lawyers range quite a bit, so shop around before you hire. Our Remax Real Estate Team can suggest some of the best real estate lawyers in Calgary or Okotoks.

Homeowner’s insurance

Your home will serve as security against your loan for your financial institution. You will be required to buy insurance in an amount equal to or greater than the mortgage loan.

Land transfer (purchase) tax

This tax applies in any situation in which a property changes owners and can vary greatly.

Moving expenses

Utility service charges

Any utilities you arrange for at your new home, such as cable or telephone, may come with an installation fee.

Interest adjustments

Renovations to your new home

In order to “make it their own,” many new homeowners like to paint or invest in other renovations prior to or upon moving in to their new home. If this is your plan, budget accordingly.

Maintenance fees

If you are moving to a new condominium, you will likely be charged a monthly condo fee which covers the costs of common area maintenance.

If you are considering buying a home, contact our professional Real Estate Team for more information, advice, or to begin your search for a new home!