Posted on

October 22, 2024

by

Jay Magnussen

We have been holding this fun fall event for several years in Okoktoks but to be honest, we can’t recall exactly how many years… so I am going to semi-confidently say this is the 6th Annual Pumpkin Patch for the Okotoks Foodbank. As local business people, it is essential to us to give back to our wonderful community that continues to support our Real Estate business. Thank you David West and West Legal and Adam Mansbridge Mortgage Broker for sponsoring the event. Thank you Red Dot Services for your kindness. Thank you to Hubtown Brewing for allowing us to take over your patio for our event. It is a wonderful spot and has quickly become a favorite for many residents, including us!

Posted on

March 11, 2022

by

Savannah Magnussen

Posted on

September 17, 2020

by

Savannah Magnussen

Fall is a beautiful time of year and the hallmark icon of the fall is arguably a pumpkin; this coupled with it being our team's FAVORITE season leads us to want to do something in the community to celebrate the season and give back.

Please join us on Saturday, October 24 between 12:00 - 4:00 pm to collect a FREE pumpkin in exchange for a donation of food or cash to the Okotoks Foodbank. You can find us in the parking lot of the Okotoks Foodbank located at 220 Stockton Avenue.

We will be passing out treats to kiddos dressed in costumes and serving up free hot chocolate as well.

Thanks for your support.

Thank you to our co-sponsors Lozinsky-Flett Law Office and Adam Mansbridge Mortgage.

Posted on

July 12, 2020

by

Savannah Magnussen

RE/MAX agents want to recognize those who have contributed during these unprecedented times. To enter, entrants will nominate an individual who they feel is deserving of a chance to win a once-in-a-lifetime VIP RE/MAX hot air balloon flight for two. Contest winners will be randomly drawn on the draw dates noted below.

The ‘Above the Crowd!® with RE/MAX Contest’ period runs from July 1st, 2020 to August 31st, 2020. All residents of British Columbia, Alberta, Saskatchewan, Manitoba, Yukon, or Northwest Territories who have reached the age of majority in their province or territory may put forward a nomination in the contest. All nominees must reside in Alberta, Saskatchewan, or Manitoba and must also have reached the age of majority in their province of residence.

There will be two draw dates during the contest period: July 31, 2020 at 9:00 a.m. PT and September 1, 2020 at 9:00 a.m. PT. On each draw date, two eligible contest entries will be randomly drawn per city (Edmonton, Calgary, Saskatoon, Regina, and Winnipeg) from among all contest entries received during the contest period. Nominees from the drawn contest entries will be subject to win! Only nominees will be eligible to win, on both draw dates, excluding the winners from the July 31 draw. Chance of being drawn to win depends on the number of eligible contest entries received.

Balloon flights depart out of Edmonton, Calgary, Saskatoon, Regina, or Winnipeg only. Passengers must be willing to make a 6:00 am flight departure out of one of the previously mentioned cities. Full details will be discussed with the winners. Flights are weather permitting, and the pilot reserves the right to cancel flights for safety reasons. In the case of cancellation, the flight may be rescheduled within the 2020 or 2021 flight seasons. All reasonable attempts will be made to fly the winners in the 2020 or 2021 seasons, with the 2021 season ending on October 31, 2021. The approximate value of the prize is $700 CAD. There is no cash trade-in value for the prize.

- Entry period is from July 1, 2020 to August 31, 2020

- Two draw dates:

- Friday, July 31 @ 9:00am PT

- Tuesday, September 1 @ 9:00am PT

- Two winners will be randomly drawn on each draw date from each market (Calgary, Edmonton, Regina, Saskatoon, Winnipeg), for a total of four (4) winners drawn in each market over the length of this promotion; twenty (20) winners in total

- Each winning entry will win one (1) V.I.P. flight for two in the RE/MAX hot air balloon, approx. value $700 CAD.

- Each winning entry will be allowed to bring one (1) companion on their flight

- Prizes must be redeemed by October 31, 2021

Posted on

January 17, 2020

by

Savannah Magnussen

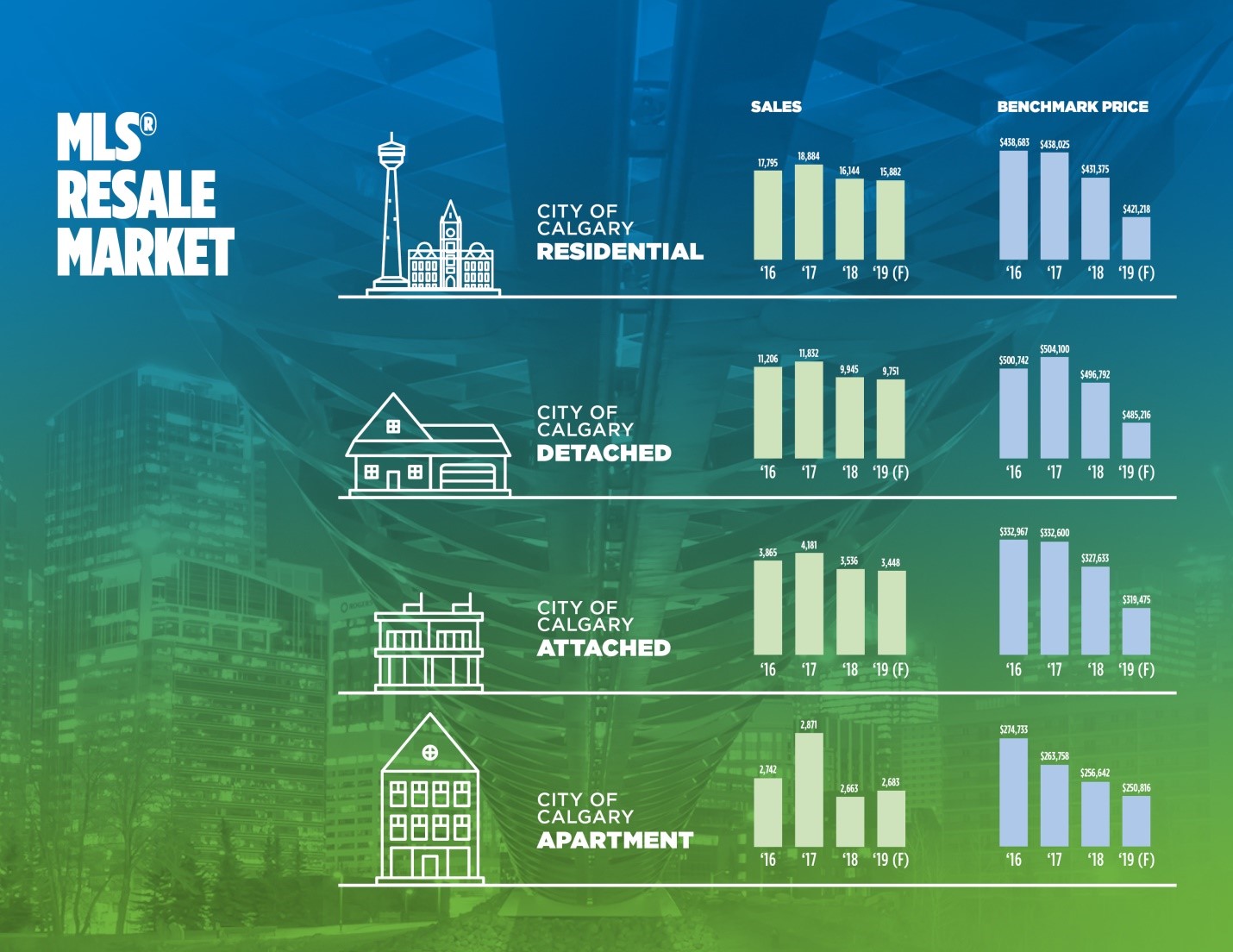

The following is a summary from our attendance at the Calgary Real Estate Board's Annual Forecast workshop:

2019 IN REVIEW

The biggest economic changes that impacted real estate in 2019 was mortgage rates & mortgage rules as well as job growth (4% job growth over 2018).

The lower end of the market was experiencing stability, while the higher end of the market was suffering.

There was a palpable shift towards “more affordable” living in light of job loss, wage decreases, economy struggling, etc. A fundamental change in consumer preferences, resulting in more cautious spending. Consumers are making fewer large purchases and when they do, including investing, they make these decisions with more caution.

Household incomes are 7% lower on average than they were in 2014.

There has been a 10% price decrease across the entire Calgary & area real estate market since 2014.

2020 FORECAST

The economy is expected to continue to struggle.

The real estate market in Calgary and surrounding areas such as Okotoks, Airdrie, Cochrane and more will continue to favor the buyer.

Economists expect re-sale home sales start to improve slightly with modest growth following a weak 2019.

The general expectation is cautious optimism that the TMX pipeline will get built, eventually... And when it does that this will be a definite source for improvement in the real estate market.

Employment levels are not expected to change very much.

In terms of population growth, we still have more people moving to Alberta than leaving; but at a lower level than “booming” times. Now it is at more comparable levels to other cities with “normal” population growth.

Rental market vacancy rates are starting to decline.

Bank of Canada interest rates are expected to maintain or cut rates - encourages sales activity. This creates a favorable lending environment for the spring real estate market.

Supply (# of resale homes on the market) reductions are expected throughout 2020. Inventory is still higher than normal but is expected to come down.

New home sales - the bulk of new home starts are in the apartment sector.

There has been a 10% price decrease across the entire Calgary, Okotoks & area real estate market since 2014. All home sectors continue to be over-supplied (detached, attached & condo). The pace of decline should start to ease this year.

Risks - global concerns/US economy creating anxiety amongst companies and investors, energy price volatility, government cuts to education and health care which have been sectors with the healthiest growth in recent years, the mortgage stress tests, the number of new home starts competing with resale homes.

In consumer behaviors and feedback we see that homeownership is still about more than just an investment - it is about housing stability, lifestyle, personal investment, cost certainty and more.

CONTACT US

If you have any questions or would like to discuss this information we would be happy to chat over the phone, or schedule a coffee meeting.

Want to know what your home is worth today?

For a free, no-obligation CMA Comparative Market Analysis for your property please contact Jay Magnussen or Savannah Magnussen.

Posted on

November 12, 2019

by

Savannah Magnussen

We are so excited for one of our favorite annual Okotoks events - LIGHT UP OKOTOKS. Thousands of people will flood the streets of Olde Towne Okotoks and downtown Okotoks to take in vendors, holiday activities, visit shops and see the lighting of the town Christmas Tree. The true spirit of our lovely town really shines at this event. We can expect seasonally warm weather which makes the event exceptionally enjoyable.

Light Up Okotoks: Friday, November 15 from 5:30 - 9:00 pm

Magnussen Real Estate Team - Jay Magnussen and Savannah Magnussen - are sponsoring a firepit that will be located on the corner of Veteran's Way by The Duke. We will have a hockey net set up where visitors to Light Up Okotoks can "Shoot To Win" an awesome hockey-themed prize pack. Come pay us a visit!

DOWNLOAD Light Up Okotoks Map

Posted on

April 26, 2019

by

Savannah Magnussen

Okotoks Parade & Children's Festival

Saturday, June 15, 2019 - 11:00 am to 3:00 pm

The Okotoks Parade & Children's Festival have been a hugely popular event every year. The Parade begins at 11 am in Downtown Okotoks. The Children's Festival, presented by TD, follows at 12 pm, and includes crafts, face painting, food, and always live entertainment! This year's entertainers Michelle & Friends and the Purple Pirate Magic Show are sure to be a hit!

Be sure to wave and say hello to our team members Jay Magnussen, Savannah Magnussen & Neil Donnelly when you see Magnussen Real Estate Team at the parade! Our agents are friendly and always willing to talk about the real estate market in Okotoks!

Posted on

March 5, 2019

by

Savannah Magnussen

Buying a home may seem daunting or overwhelming at first - particularly if you're a first-time home buyer. Between mortgage rates, property taxes, negotiating with sellers, and closing the deal, it's easy to feel overwhelmed. There's so much at stake! But don't worry - we got you!

If you familiarize yourself with what it takes to buy your first home beforehand, it can help you navigate the real estate market with ease. So let's get started! We have outlined the major steps that are involved in buying a home in Okotoks or Calgary.

Step 1: Start gathering a down payment

The very first step every first-time home buyer should tackle is to figure out their finances. Buying a home (particularly for the first time) requires a mortgage, where a lender fronts you the money and you pay them back over time. However, in order to get a mortgage, you'll need to put down some sort of down payment.

So how much down payment do you need? Ideally, a down payment on a mortgage should be 20% of the home's price to avoid added fees, but if you don't have that much, don't worry. A mortgage down payment can be as low as 10%, 5% and it's best to consult with a mortgage broker (we can refer a few GREAT ones!)

Step 2: Check your credit score

In addition to having a down payment, a first-time home buyer will need a decent credit score. This three-digit number is a numerical summary of your credit report, a detailed document outlining how well you've paid off past debts like for credit cards and college student loans. A lender will check your score and report in order to estimate the odds that you will deliver your monthly payment to them, too. In turn, they will use this info to decide whether or not to loan you money, as well as how much, and at what interest rate.

If a lender sees some late payments or other blemishes in your credit report, this can lower your odds of getting a loan with a great interest rate, or perhaps even jeopardize your chances of getting any loan at all. So, it's essential to know your score and take steps now if necessary to bring it up to snuff. Here is how you can check your credit score.

Step 3: Get pre-approved for a mortgage

Before you head out home buying in Okotoks, you should seek pre-approval from a lender for a home loan. This is where you meet with a loan officer, ideally a few at various mortgage companies. Each mortgage lender will scrutinize your financial background—such as your debt-to-income ratio and assets—and use this info to determine whether they're willing to loan you money, and what size monthly payment you can realistically afford. This will help you target homes in your price range. And that's good since a purchase price that's beyond your financial reach will make you sweat your mortgage payment and puts you at risk of defaulting on your loan.

As a new home buyer, just keep in mind that mortgage pre-approval is different from mortgage pre-qualification. Pre-qualify, and you're undergoing a much simpler process that can give you a ballpark figure of what you can afford to borrow, but with no promise from the lender. Getting pre-approved is more of a pain since you'll have to provide tons of paperwork, but it's worth the trouble since it guarantees you're creditworthy and can truly buy a home.

Before they even meet with a lender, one step homebuyers can take to begin understanding what they can afford as a monthly mortgage payment is to plug their info into an online home affordability calculator. This will calculate the maximum amount you can afford as a monthly payment.

Step 4: Contact the Magnussen Real Estate Team

Want a trusty, experienced home-buying guide by your side? Most first-timers will want a great real estate agent—specifically a buyer's agent, who will help you find the right houses, negotiate a great real estate deal, and explain all the nuances of home buying along the way. Like we said - we've got you covered. Find out more about our amazing real estate agents in our "Meet The Team" section. We know the Okotoks Real Estate market inside and out. We also serve clients in Calgary, High River, Airdrie and other surrounding areas covered by the Calgary Real Estate Board.

The best part??? Our services are FREE to first-time home buyers since the seller pays the sales commission!

Step 5: Go home buying!

This is the fun part! As a buyer, you can peruse thousands of real estate listings on our website, Realtor.ca, or through the targetted email search we will set up for you! Then ask your Jay Magnussen, Savannah Magnussen or Neil Donnelly to set up appointments to see your favorites in person. Since the sheer number of homes can become overwhelming, it's best to separate your must-haves from those features you'd like, but don't really need. Do you really want a new home or do you prefer a fixer-upper? Make a list of your wants and needs to get started, and whittle down your options.

Step 6: Make an offer

Found your dream home? Then it's time to make an offer to the seller. Our professional Remax real estate team will offer you market insights and do a property CMA before deciding what to offer on this home. We got you.

Step 7: Get a home inspection

A home inspection is where you hire a home inspector to check out the house from top to bottom to determine if there are any problems with it that might make you think twice about moving forward. Think mold, faulty foundation, plumbing issues, etc. Sure, a lot can go wrong, but rest assured that most problems are fixable.

Step 8: Get a home appraisal

Even if you got pre-approved for your home loan, your lender will want to conduct a home appraisal. This is where they check out the house to make sure it's a good investment. It's similar to a home inspection, but for your lender.

Step 9: Head to closing

Closing brings together a variety of parties who are part of the real estate transaction, including the buyer, seller, mortgage representative, lawyers, and others.

Closing is the day you officially get the keys to your new home—and pay all the various parties involved. That will include your down payment for your loan, plus closing costs, the extra fees you pay to process your loan.

Step 10: Move in!

Done with closing? Got your loan? Congratulations, you've officially graduated from a buyer to a homeowner! See, the home-buying process wasn't so scary after all, right? Now it's time to kick back and enjoy the many beneits of becoming a homeowner.

Posted on

March 5, 2019

by

Savannah Magnussen

We define success differently

We don't think of success as the most money earned or the most deals closed but rather - we define success as how well we service our clients and how happy they are in the results we deliver. For us, true success isn’t achieved without our clients first feeling like they've won.

We like to help people

We get a great deal of satisfaction knowing we helped our clients find their first home or their dream home. We love being able to deliver honest, ethical, fair service and have our clients rest easy that we will never cut corners. We love negotiating for our clients and getting them top dollar for their home.

We also have a passion for helping people in our community! Our team volunteers every month at the Okotoks Foodbank, we volunteer with the Okotoks Jr. A Oilers on many occasions, we are proud supporters of the Foothills AIM Society, Dewdney Players, and more! You will see Jay ringing bells at the Salvation Army kettles during the Christmas season. We have several annual events that benefit local charities. Savannah is the President and Founder of a national non-profit organization that supports police families - Beyond The Blue. Giving back is very important to us - click here to read more!

We are service driven

You don't work for us, we work for you! We go out of our way to take excellent care of our clients and make them feel valued. We help stage and prepare your home for sale. We keep in regular contact with you during the home buying or selling process. We follow up after your showings for feedback. We give our clients some pretty awesome thank you gifts ;-) and much more! You will love being a Magnussen Real Estate team client!

Experience

Jay Magnussen has been thriving in the real estate market since 2003, winning numerous awards for sales like the Remax Hall of Fame Award, customer service awards, benevolence & community impact awards and more. Since 2008 Jay has managed a team of Realtors, mentoring them with great success. Savannah Magnussen has been working with the team since 2008, attaining her real estate license in 2018 with ample experience in customer care, home staging, marketing and more. Neil Donnelly brings over 15 years of experience in new home sales prior to joining our Okotoks Real Estate Team and is passionate about helping his clients.

We are here, even after we’re done

Just because we have helped our client’s find the perfect new home or sell their home with excellent results, it doesn’t mean that I’m not available to them once it’s all said and done. We develope relationships with our clients and like to keep in touch. If you ever have real estate questions we are just a short phone call away.

Contact us today to find out how we can help you with your real estate needs!

Posted on

March 3, 2019

by

Savannah Magnussen

You’ve been saving a down payment for a while, weighing your options, looking around at real estate casually. Now you’ve finally decided to do it — you are ready to buy a house! The process of buying a home in Okotoks or Calgary can be incredibly exciting, yet stressful, all at once. Where do you start?

It is essential you do your homework before you begin. Learn from the experiences of others, do some research. Of course, with so many details involved, slip-ups are inevitable. But be careful: learning from your mistakes may prove costly. Use the following list of pitfalls prepared by our professional Remax Real Estate Team as a guide to help you avoid the most common mistakes.

Mistake 1 - Searching for houses without getting pre-approved by a lender:

Do not mistake pre-approval by a lender with pre-qualification. Pre-qualification, the first step toward being pre-approved, will point you in the right direction, giving you an idea of the price range of houses you can comfortably afford. Pre-approval, however, means you become a cash buyer, making negotiations with the seller much easier. As an Okotoks Realtor we have built relationships with many Okotoks Mortgage Brokers and are happy to refer you to one of these brokers.

Mistake 2 - Allowing “first impressions” to overly influence your decision:

The first impression of a home has been cited as the single most influential factor guiding many purchasers’ choice to buy. Make a conscious decision beforehand to examine a home as objectively as you can. Don’t let the current owners’ style or lifestyle sway your judgment. Beneath the bad décor or messy rooms, these homes may actually suit your needs and offer you a structurally sound base with which to work. Likewise, don’t jump at home simply because the walls are painted your favorite color! Make sure you thoroughly investigate the structure beneath the paint before you come to any serious decisions. Magnussen Real Estate will help gude you throug this tricky world.

Mistake 3 - Failing to have the home inspected before you buy:

Buying a home in Okotoks or Calgary is a major financial decision that is often made after having spent very little time on the property itself. A home inspection performed by a competent company will help you enter the negotiation process with eyes wide open, offering you added reassurance that the choice you’re making is a sound one, or alerting you to underlying problems that could cost you significant money in both the short and long-run. Our team of real estate agents can suggest reputable home inspection companies for you to consider and will ensure the appropriate clause is entered into your contract.

Mistake 4 - Not knowing and understanding your rights and obligations as listed in the Offer to Purchase:

Make it a priority to know your rights and obligations inside and out. A lack of understanding about your obligations may, at the very least, cause friction between yourself and the people with whom you are about to enter the contract. Wrong assumptions, poorly written/ incomprehensible/ missing clauses, or a lack of awareness of how the clauses apply to the purchase, could also contribute to increased costs. These problems may even lead to a void contract. So, take the time to go through the contract with a fine-tooth comb, making use of the resources and knowledge offered by your real estate agent and Lawyer. With their assistance, ensure you thoroughly understand every component of the contract and are able to fulfill your contractual obligations.

Mistake 5 - Making an offer based on the asking price, not the market value:

Ask your real estate agent for a current CMA (Comparative Market Analysis). This will provide you with the information necessary to gauge the market value of a home, and will help you avoid over-paying. What have other similar homes sold for in the area and how long were they on the market? What is the difference between their asking and selling prices? Is the home you’re looking at under-priced, over-priced, or fair value? The seller receives a Comparative Market Analysis before deciding upon an asking price, so make sure you have all the same information at your fingertips.

Mistake 6 - Failing to familiarize yourself with the neighborhood before buying:

Check out the neighborhoods you’re considering ahead of time and ask around. What amenities does the area have to offer? Are there schools, churches, parks, or grocery stores within reach? Consider visiting schools in the area if you have children. How will you be affected by a new commute to work? Are there infrastructure projects in development? All of these factors will influence the way you experience your new home, so ensure you’re well-acquainted with the surrounding area before purchasing.

Mistake 7 - Not looking for home insurance until you are about to move:

If you wait until the last minute, you’ll be rushed to find an insurance policy that’s the ideal fit for you. Make sure you give yourself enough time to shop around in order to get the best deal.

Mistake 8 - Not recognizing different styles and strategies of negotiation:

Many buyers think that the way to negotiate their way to a fair price is by offering low. However, in reality, this strategy may actually result in the seller becoming more inflexible, polarizing negotiations. Employ the knowledge and skills of an experienced Real Estate Agent. Your agent will know what strategies of negotiation will prove most effective for your particular situation.

Contact our Okotoks & Calgary Real Estate Team for more helpful advice on buying a home!

Posted on

February 26, 2019

by

Savannah Magnussen

If you didn't hear about it, see it or attend it then you're probably frozen in a block of ice!

Rogers Home Town Hockey took over Okotoks the weekend of Feb 23 & 24 with well-known names like Ron McLean, Tara Slone, Alan Doyle, lots of hockey greats and more! They were super kind to attend the Okotoks Jr. A Oilers hockey game to commentate with our local broadcasters. Jay Magnussen was thrilled to enjoy lunch with Ron McLean at a local Okotoks golf club.

Olde Towne Okotoks was closed to traffic due to the mobile broadcasting trailer, stage, street hockey rink, and plenty more fun exhibits. Despite the frigid temperatures Okotoks resident showed up in droves to take in the traveling SportsNet hockey festival! We saw plenty of Okotoks Minor Hockey players hashing it out on the main street in the ball hockey rink, picked up some free swag, visited with lots of bundled up residents of Okotoks and saw tons of smiling faces. Hockey is more than a sport in Okotoks - it's a community, a way of life, a reason for people to get together, and more!

If you take a moment to think, we have a lot of really cool opportunities here in Okotoks, Home Town Hockey is just one of them. Take the time to check out an Okotoks Oilers Jr A Hockey game, or during warmer months visit the Okotoks Dawgs baseball stadium, or consider the many cool festivals and community events like the Chili Cook-Off, Parade Day and so much more!

Can you tell that we love Okotoks! Do you?

Posted on

February 4, 2019

by

Savannah Magnussen

Attention Grade 12 students: Remax of Western Canada is holding it's annual scholarship contest!

We encourage students in Okotoks, Calgary, and surrounding areas to apply for this opportunity to be rewarded with $1000 towards your post-secondary education.

Who can participate?

Grade 12 students attending high school from September 2018 to June 2019. Grade 12 students may not have participated in graduation commencement ceremonies in the past.

Applicants must be a resident of one of the following provinces/territories:

• British Columbia

• Alberta

• Saskatchewan

• Manitoba

• Yukon

What is required?

Have you led a group of volunteers, raised funds for a worthwhile cause, helped special needs children or cared for seniors? Then we want to hear from you! Submit your essay (max. 1,250 words) which conveys your motivation, leadership and communication skills in connection with your community efforts.

Prizes?

• 16 winning essays will receive $1,000 each! One of these recipients will also receive a flight for two in the RE/MAX Hot Air Balloon.*

• Bursary winners will be notified in April 2019.

• All winners will be posted on remax.ca

Opens September 10th, 2018. Deadline March 11th, 2019, midnight.

CLICK HERE TO VISIT REMAX.CA to LEARN MORE

Posted on

January 30, 2019

by

Savannah Magnussen

Economic challenges to affect Calgary’s housing market in 2019

The challenging economic climate in Calgary is expected to persist into 2019.

Easing global oil prices, concerns regarding market access and easing investment activity are weighing on the energy sector and are expected to slow growth prospects in the province this year.

"Slowing growth, weak job prospects and lack of confidence are all factors that are contributing to the expected easing in sales activity this year," said Ann-Marie Lurie, CREB® Chief Economist.

"At the same time, our market continues to struggle with high inventory levels and further potential rate hikes, all of which is expected to cause additional price declines this year."

There are signs that supply in the market is starting to adjust to slower sales, but the pace of adjustment is expected to be slow. Overall, it will help reduce some oversupply in the market and put the industry in a more stable position by 2020.

Buyers' market conditions are expected to persist throughout most of the year, impacting prices across all property types. However, the pace of decline is expected to ease by the end of the year, as concerns over the economy ease.

While further easing in the housing market is expected, this will not likely be the case for all price ranges, as demand for affordable product is expected to continue to improve, given shifts in lending requirements and adjustments in expectations.

"In this market, buyers have the advantage of choice. A REALTOR® can help buyers find a home that best fits their lifestyle," said Alan Tennant, CREB® CEO.

"For home sellers, knowing all the data and facts surrounding their home is critical to maximize their selling price. Working with a real estate professional can take the guess work out of the process."

Posted on

January 17, 2019

by

Savannah Magnussen

Buyers and sellers often have questions come to mind as they are looking at homes online. To help provide a quick response to your questions we have installed a LIVE CHAT tool directly on our website!

This means you will be connected with our of our experienced Magnussen Real Estate Team members - professional Remax Realtors - who can provide information on homes currently listed for sale, answer your questions about buying or selling a home, Okotoks or Calgary & other areas' market info and more!

Check it out today... click on the icon in the lower right-hand corner of your screen and say HELLO!!!

Always putting you first ;-)

Posted on

January 13, 2019

by

Savannah Magnussen

TAX-FREE... who doesn't love hearing those 2 words?!

If you haven’t purchased a home within the last four years (or lived in a spouse’s home in the same timeframe), you may qualify for the government’s RRSP Home Buyer’s Plan. With this plan, you may borrow up to $25,000 tax-free from your RRSP to fund your down payment. Just keep in mind that the money must be in your RRSP at least 90 days before the purchase of your house - so plan ahead!

The First Time Home Buyer’s Plan is advantageous for Canadians because generally speaking, early withdrawals from RRSPs are considered taxable income. In this case, they’re exempt but you must start repaying the amount borrowed from the RRSP two years after you buy over a 15-year period.

CLICK HERE FOR MORE INFO

After all, it is currently a buyer market in Calgary and Okotoks! If you're thinking about buying a home in Calgary, Okotoks or the surrounding areas reach out and find out how we can help you through the process of finding your first home!

The best time to buy a home was 10 years ago.

The second best time is now!

Posted on

November 15, 2018

by

Savannah Magnussen

Negotiating your deal is one of the most critical aspects of your real estate journey. It’s also one of the parts of the process where your agent’s experience can make the most dramatic difference. Your home purchase or sale, probably one of the biggest financial transactions you’ll make in your life, is not the time to test rookie negotiation skills.

Here are just a few things agents, as professional negotiators, know that help them reach the best closing agreement for you.

1. That knowledge is power

In addition to their in-depth knowledge of the market and valuing a home, your agent will have dug into public records about the property and the neighborhood. Your agent will also look into the seller’s motivation. Knowing things like whether the seller is under pressure to move quickly can help shape negotiating strategy.

2. How to time it

Sometimes a quick response to an offer is critical. Other times, it’s best to keep the other party on the hook. Knowing which strategy to employ is crucial in negotiations.

3. Objectivity is a must

As a professional negotiator, your agent is able to control the process without being affected by the emotions that swirl around real estate transactions for buyers and sellers. Among other potentially expensive missteps, inexperienced negotiators can reveal too much info to the other party, especially during intense, fast-moving negotiations.

4. What to ask for

If you don’t ask for something, you won’t get it. As your advocate, your agent will know how to ask for things like concessions and repairs in a manner that’s most appealing to the other party.

Selling your bike online? Go forth and make a killer deal on that two-wheeler. But when it comes to buying or selling your home, stick with a professional. Real estate negotiation is no place for training wheels.

Contact us to find out how Magnussen Real Estate Team can be YOUR negotiator in your next real estate deal!

Source: Remax.com/blog

Posted on

November 1, 2018

by

Savannah Magnussen

Oversupplied market weighs on prices

Elevated inventory levels compared to sales, are causing prices to ease further in Calgary’s housing market.

Citywide benchmark prices totaled $426,300 in October, trending down for the fifth consecutive month and resulting in a year-over-year decline of 2.9 per cent.

“Job growth in this city remains a concern, as unemployment levels remain well above levels expected for this year. Rising costs of ownership also continue to weigh on housing demand,” said CREB® chief economist Ann-Marie Lurie.

“At the same time, housing supply levels are not adjusting fast enough to current conditions, resulting in price adjustments.”

Inventories and sales totaled 7,345 and 1,322 in October. This has resulted in months of supply of 5.6, above levels typical for this month. While some easing in new listing growth will help prevent further inventory gains, inventory levels remain near record highs for the month of October.

“With these types of market conditions, many potential buyers should be able to find the home that they are looking for with well priced listings appearing in certain price ranges,” said CREB® president Tom Westcott. “Sellers need to manage expectations and have accurate data in order to be aware of what is selling in their community.”

For each of the property types, sales activity has improved in the lower price ranges, leaving most of those segments relatively balanced. However, the upper end of the ranges has seen significant gains in supply compared to demand, which is likely having more of an impact on prices in those ranges.

HOUSING MARKET FACTS

Detached

- Detached sales in October totaled 829 units, for an 8.6-per-cent decline, resulting in a year-to-date decline of 15 per cent. This is the slowest level of detached sales since the late ’90s.

- Year-to-date, the largest decline in sales occurred in the $600,000 – $999,999 price range, reflecting slow demand coming from move-up buyers.

- For the second month in a row, new-listing growth eased, helping prevent further inventory gains. However, as this segment remains oversupplied, prices continue to trend down.

- Detached benchmark prices totaled $490,200 in October. This is below last month and three per cent below last year. On a year-to-date basis, prices remain one per cent below last year’s levels.

- As of October, year-over-year prices have eased across all districts, with the largest declines occurring in the North East, North West, South and South East districts. This is likely a result of added competition from the new-home sector.

Apartment

- Year-to-date apartment sales have totaled 2,316 units, nearly seven per cent below last year. New listings have also eased by six per cent, helping reduce the amount of inventory in the market.

- Despite the easing inventories, the months of supply remains elevated at 7 months.

- Year-to-date apartment condominium prices have eased by 2.8 per cent and remain 14 per cent below 2014 highs. Declines occurred across all districts, with the steepest declines occurring in the North East, East and South districts.

Attached

- The attached sector has recorded year-to-date sales of 3,098. This is 15 per cent below last year and 14 per cent below long-term averages.

- Meanwhile, despite recent easing in new listings, October inventories are the highest level on record.

- The oversupply is affecting both the semi-detached and row sectors, which have seen prices trend down over the past 5 months.

- Year-to-date, row benchmark prices have averaged $298,140 this year, nearly two per cent below last year and nine per cent below previous highs. However, prices have remained relatively flat in both the City Centre and North West districts.

- As of October, semi-detached prices were $403,400, one per cent lower than last month and nearly three per cent lower than last year. Despite recent declines, year-to-date citywide prices remain relatively flat compared to last year. This was most due to gains in the City Centre, North East and East districts offsetting declines in the North West, South and South East.

REGIONAL MARKET FACTS

Okotoks

- Year-to-date residential sales have declined to 428 units in 2018, comparable to levels from 2011 and well below long-term averages.

- New listings are elevated at 936 units, which is eight per cent higher than last year’s levels and close to long-term averages. Inventory levels in October remain elevated with 232 units.

- Despite gains in the amount of supply compared to sales, Okotoks detached prices have seen some modest gains. Year-to-date benchmark prices for detached properties totaled $436,660, 1.25 per cent higher than last year.

Airdrie

- Airdrie’s housing market continues to experience declining sales and increasing inventory compared to last year. Elevated supply levels have led to downward pressures on the benchmark prices for detached homes.

- Total year-to-date residential sales have reached 1,032 units, 11 percent below levels last year. Year-to-date, new listings have remained relatively stable, but remain well above long-term averages.

- Year-to-date average inventory levels are 19 per cent higher than. As a result, months of supply have been elevated, and presently stand at six months. This has translated to sustained pressure on benchmark price, with the year-to-date value of detached homes now sitting at $370,880, which is a year-over-year decline of nearly two percent.

Cochrane

- Year-to-date, residential sales have declined by 10 per cent, with 530 sales so far in 2018. These levels are comparable to similar periods in the past few years and higher than long-term averages.

- At 1,164 units, new listings have reached a historical peak for this period and well above long-term averages. Inventory levels in Cochrane for 2018 have been persistently elevated and are almost 17 per cent higher than the same period last year.

- This has started to place some downward pressure on prices. However, year-to-date detached benchmark prices have remained relatively stable compared to last year with a benchmark price of $424,900.

Source: CREB.com

Posted on

October 23, 2018

by

Savannah Magnussen

Join us on Friday, November 16 from 5:30 - 9:00 pm on Elizabeth Street (aka Main Street) in Okotoks for FREE Starbucks hot chocolate and coffee. Yes, we said FREE!!!! LOL.

Yes, we will have whipped cream and candy cane sprinkles to top your yummy hot drinks!

Light Up Okotoks is a wonderful, long-standing tradition in the Town of Okotoks, kicking off the Holiday Season with the lighting of the big Christmas Tree is Olde Towne Okotoks plaza! The event has grown to include many exhibitors, vendors lining the streets offering townspeople food and drinks - not to mention the wonderful array of shops open for your browsing!

Despite cold weather, you will find CROWDS of people packing the street as it is such a lovely, fun, cheerful event that really displays the spirit of this wonderful town! Luckily we are sponsoring a FIRE PIT - so stand close and stay warm.

Posted on

October 23, 2018

by

Savannah Magnussen

Our team was on hand to lend a hand (and enjoy a Grand Slam breakfast) at Denny's in Okotoks to help with their annual event to raise money for the Okotoks Foodbank! You can see Jay Magnussen serving Okotoks Mayor Bill Robertson!

We want to extend a HUGE thanks to the hardworking staff and Manager at Denny's Okotoks for supporting the Okotoks Foodbank with their Annual $1.99 Grand Slam Breakfast event! The proceeds from all Grand Slam Breakfasts bought on this day will benefit our local Foodbank that does such an awesome job in the community!

We truly enjoy helping out in the community! Let us know if you've got an event that you need volunteers, silent auction prizes, etc! Email Savannah Magnussen - Savannah@MagnussenRealEstate.com.

Great work!

|